An efficient tool for financial risk assessment

Abraxas Rating is an efficient and adaptable tool for financial risk management and creating credit reports.

With this tool you can determine a very accurate credit rating and fully estimate the financial risk of doing business with a certain company. Beside the usual financial data you can also take soft factors into consideration which generally have a great influence on business risk.

It is suitable for banks and financial institutions.

Integrity

With Abraxas Rating you can comprise all the factors that influence the financial risk in the calculation. Our tool, as well as other tools for credit rating calculation, enables you to take into account all the financial data you acquire from your internal and external sources.

Abraxas Rating is unique because you can also consider factors which cannot be taken into account by most of the other tools. With this we mean those factors which are not numerically definable and cannot be gained from an external data base.

However, these are the factors that have an important impact on risk assessment of a certain enterprise. These soft factors can usually be found in different places in your current information system but with our solution you can also use them. Such data is, for example, experiences that a bank already has with a certain business partner: previous business cooperation, how they settle liabilities, credit payment delays, etc.

The complexity of a credit report

Usual tools calculate credit assessment by using some of the most frequent financial indicators.

Abraxas Rating also includes all the standard financial indicators.

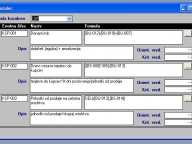

Abraxas Rating is unique because you can freely define additional, complex financial indicators used in the process of risk assessment. These additional indicators are automatically calculated from the basic, already built-in indicators or from those additionally defined by you.

Integration

A distinctive feature of Abraxas rating is also that we can connect it with your current information environment including both external and internal data sources. In this way you can calculate current data in each analysis.

Adaptability

There is no universal solution for detailed and accurate calculation of risk and credit rating. Each of our clients has a unique system of doing business and they apply different methods of risk assessment.

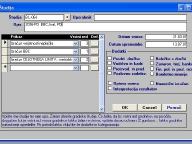

The adaptability of our solution comes to the fore here. Beside the option of defining already mentioned additional financial indicators, economic categories, and integration, Abraxas Rating enables you to make simple and detailed credit reports. For this purpose several standard reports designed in advance are integrated in Abraxas Rating.

You can make other reports that suit your demands or demands of your business with the help of a built-in connection with office programs.

A distinctive feature of Abraxas Rating is also that you can automatically create the proposal for the credit committee.

Automation

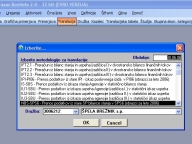

You need to make a lot of credit assessments and credit proposals, therefore it is important that this process is automated and you do not need to do it manually. The process is automated because Abraxas Rating is integrated with your information system and data source. Besides, the process is also supported by the system for an automated interpretation of results.

The system for the automated interpretation of results is a unique algorithm which converts the numerical result of credit rating analysis into text. Therefore you do not need to do it manually.